The biggest companies in the world are using their significant cash piles to pump up their stock prices intao year-end.

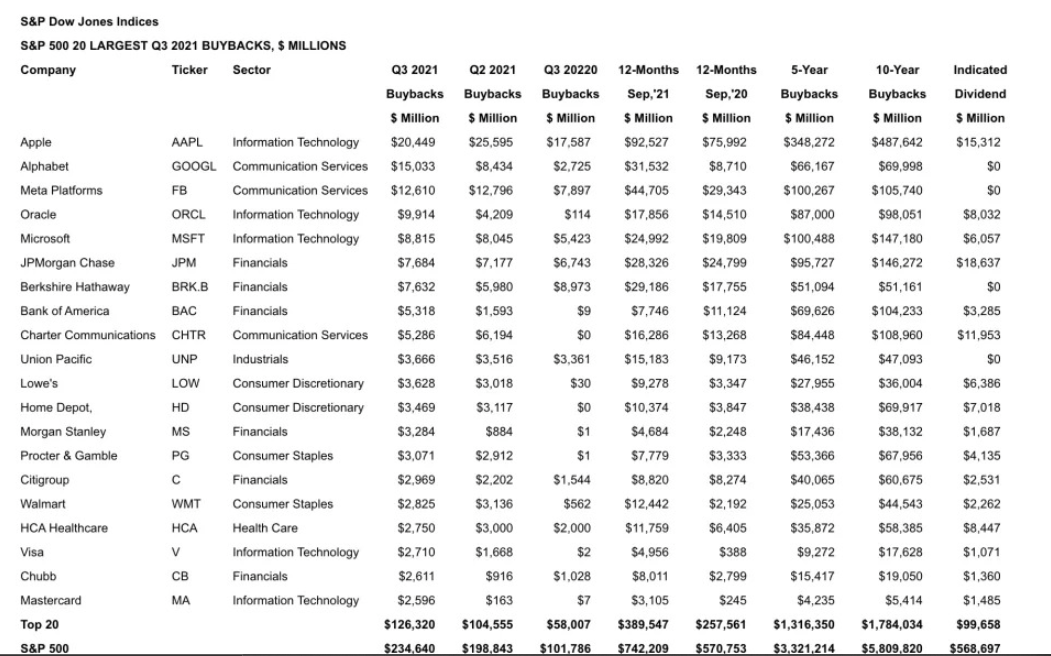

About 53.8% of third quarter stock buyback activity was fueled by the top 20 companies, according to new data from S&P Dow Jones Indices senior index analyst Howard Silverblatt. The top 20 list (see below) was headlined by a who’s who of the rich and powerful in corporate America: Apple, Alphabet, Meta, Oracle and Microsoft.

These five companies alone repurchased a startling $66.7 billion of their stock in the third quarter. Zoom out a bit, and the repurchase activity of these five companies is even more impressive: $211.6 billion in the aggregate.

“Apple continued to be the poster child for buybacks as it again spent the most of any issue, with the Q3 2021 expenditure ranked eighth highest in S&P history,” said Silverblatt.

The aggressive buying of stock by companies — which has the effect of lowering share counts and juicing earnings per share —in the third quarter was noteworthy beyond the 20 largest companies listed by Silverblatt.

Third quarter buybacks among S&P 500 companies tallied $234.6 billion, up 18% from the second quarter and 130.5% from one year ago. For the 12-months ended September 2021, buybacks totaled $742.2 billion — up 21.8% year-over-year.

The outlook for buyback activity remains strong, said Silverblatt.

“At this point, a slight market downturn or correction could also see additional buying, as companies with strong (and expected strong) cash-flow stock up on shares. The proposed 1% buyback tax is not expected to materially impact buybacks, as the average daily high/low spread is near that mark (0.97%), showing that timing (or dollar averaging) is just as important,” added Silverblatt.