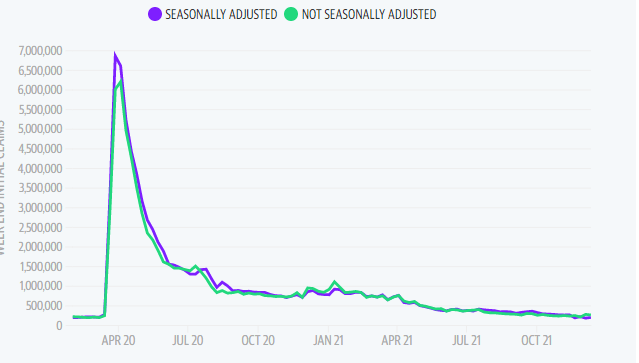

New weekly jobless claims likely held below pre-pandemic levels last week, further underscoring still-solid demand for labor heading into the new year.

The Labor Department is set to release its latest weekly jobless claims report Thursday at 8:30 a.m. ET. Here are the main metrics expected from the print, based on consensus estimates compiled by Bloomberg:

- Initial jobless claims, week ended Dec. 18: 205,000 expected vs. 206,000 during prior week

- Continuing claims, week ended Dec. 11: 1.843 million expected vs. 1.845 million during prior week

This week’s new jobless claims report will coincide with the survey week for the December monthly jobs report from the Labor Department, offering an early indication of the relative strength expected in that print due for release in early January.

At 205,000, initial unemployment claims are expected to come in below even pre-pandemic levels yet again, with jobless claims having averaged around 220,000 per week throughout 2019. Earlier this month, first-time unemployment filings fell sharply to 188,000, or the lowest level since 1969. And based on last week’s report, the four-week moving average for new claims was also at its lowest in 52 years, dropping by 16,000 week-over-week to reach 203,750.

U.S. JOBLESS CLAIMS RISE, HOLDING NEAR 52-YEAR LOW

Continuing claims have also come down sharply from pandemic-era highs, albeit while remaining slightly above the 2019 average of about 1.7 million. This metric, which counts the total number of individuals claiming benefits across regular state programs, is expected to come in below 2 million for a fourth straight week and reach the lowest level since March 2020.

“The claims data indicate strong demand for workers and a reluctance by businesses to lay off workers,” Rubeela Farooqi, chief economist for High Frequency Economics, wrote in a note. “However, disruptions around Omicron and Delta could be a headwind if businesses have to close for health-related reasons.”

“Overall, the direction in the labor market recovery remains positive, with demand still strong,” she added. “Labor shortages are persisting, preventing a stronger recovery, although these appeared to ease somewhat in November.”

And indeed, policymakers have also taken note of the improving labor market situation. In a press conference last week, Federal Reserve Chair Jerome Powell maintained, “Amid improving labor market conditions and very strong demand for workers, the economy has been making rapid progress toward maximum employment.” And at the close of the Federal Open Market Committee’s latest policy-setting meeting, officials decided to speed their rate of asset-purchase tapering, paring back some crisis-era support in the economy as the recovery progressed.

Many Americans have also cited solid labor market conditions, especially as job openings hold at historically high levels. In the Conference Board’s latest Consumer Confidence report for December, 55.1% of consumers surveyed said jobs were “plentiful.” While this rate was down slightly from November’s 55.5%, it still represented a “historically strong reading,” according to the Conference Board.

This post will be updated with the Labor Department’s weekly jobless claims report at 8:30 a.m. ET on Thursday. Check back for updates.