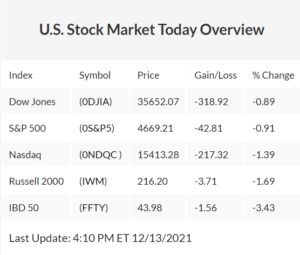

The Dow Jones Industrial Average slipped, with Boeing (BA) a key laggard as growth stocks were mauled. AMC Entertainment (AMC) and GameStop (GME) cratered amid a meme stock sell-off. Bitcoin took a dive after Tesla (TSLA) CEO Elon Musk spoke out against the cryptocurrency.

While overall action was challenging, a number of names managed to test entries. National Storage Affiliates Trust (NSA), Novo Nordisk (NVO) and S&P Global (SPGI) were among stocks that passed buy points.

Volume 0%

Markets are currently gearing up for the latest Federal Reserve meeting, which takes place Tuesday and Wednesday. Oanda senior market analyst Edward Moya said this was weighing on indexes.

“U.S. stocks were under pressure as many investors began to fear a trading life without a Fed safety net,” he said in a note to clients. “A raft of central bank rate decisions this week will likely show stocks will have to move higher without the help of central bankers.”

Nasdaq Slips As Growth Stocks Get Spanked

The tech-heavy Nasdaq suffered once again, closing down 1.4%. It is now seeking support at the 50-day moving average. The S&P 500 also fell, though by a more moderate 0.9%.

The S&P 500 sectors were mostly in the red, with real estate and utilities faring best. Energy and consumer discretionary were the worst laggards.

Small caps were once again hit, with the Russell 2000 falling 1.7%.

But growth stocks fared worst. The Innovator IBD 50 ETF (FFTY), a bellwether for growth stocks, fell more than 3.4%.

FFTY lost ground on the long-term 200-day moving average, which is a key technical benchmark.

Dow Jones Today: Boeing Dives As Coca-Cola Fizzes

The Dow Jones Industrial Average also took a tumble, closing down 0.9%.

Boeing (BA) was the biggest laggard, falling 3.7%. The jet maker’s stock posted a third straight session of declines.

The aerospace giant is suffering amid ongoing Covid worries. BA is currently trading below its 50-day and 200-day lines.

Coca-Cola (KO) fared best on the blue-chip index. It closed up 2.6% after being upgraded to overweight from neutral by JPMorgan.

Bitcoin Plunges After Elon Musk Says This

The price of Bitcoin took a dive after Tesla CEO Elon Musk touted Dogecoin over Bitcoin in an interview with Time magazine.

“Fundamentally, Bitcoin is not a good substitute for transactional currency,” said the executive, who is the magazine’s 2021 Person of the Year. “Even though it was created as a silly joke, Dogecoin is better suited for transactions.”

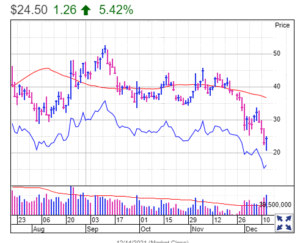

Riot Blockchain Inc (RIOT)

He said that Bitcoin is better used as a store of value, even though it is now well off its all-time high of $67,553.95. Musk pointed out that the transaction volume of Bitcoin is low, while its cost per transaction is high.

Bitcoin is continuing to sell off. It was trading for just under $47,000, after falling about 7% in the past 24 hours, according to CoinDesk.

Bitcoin plays such as Riot Blockchain (RIOT) and Coinbase Global (COIN) struggled. Bitcoin miner RIOT closed down more than 6%, while cryptocurrency exchange COIN slipped nearly 2%.

Meanwhile, Leaderboard stock Tesla was also struggling Monday. It closed down 5%. A bearish move below its 50-day moving average saw exposure to the stock trimmed on the prestigious IBD Leaderboard list of top stocks.

AMC Stock, GameStop Crater

The bubble in meme stocks was badly punctured Monday, as investors continue to wind down their exposure to risk.

AMC stock was given a stiff spanking by the bears, closing down more than 15%.

A M C Entmt Hldgs Cl A (AMC)

AMC stock lost more ground on its 200-day moving average. Earlier this year, it traded nearly 800% above this key benchmark.

When a stock rises 70% to 100% above its 200-day line, it’s usually a sign of a climax run.

GameStop, the original meme stock, was also getting pummeled by the bears, closing down nearly 14%.

Analysts have said that the stocks are becoming easier to short once again as demand falls. Massive short squeezes driven by retail investors caused the meme stocks to reach giddying heights, despite weak underlying fundamentals.

Covid Stocks Rally, Travel Plays Struggle Amid Omicron Fears

Markets are still weighing up the implications of the omicron variant of Covid-19. In total, Covid cases have topped 270 million, with over 5 million deaths, according to Worldometer. In the U.S., cases are approaching 51 million with nearly 818,000 deaths.

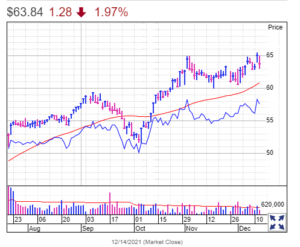

Pfizer Inc (PFE)

Among Covid-19 vaccine makers, Pfizer (PFE) rallied more than 4% in solid volume.

The firm’s vaccine partner, BioNTech (BNTX), rose nearly 8% to retake its 50-day moving average. Moderna (MRNA) is back above its 200-day line after popping almost 6%.

Pfizer seemed to get a boost on acquisition news. On Monday, the firm revealed it has agreed to buy Arena Pharmaceuticals (ARNA) for $100 per share. This values Arena at about $6.7 billion. That’s nearly double Arena’s closing price of 49.94 Friday. Arena stock closed up more than 80% but is still below the purchase price.

Travel stocks were getting punished amid the ongoing uncertainty. Lodging play Airbnb (ABNB) was down more than 5%. Among airline stocks, American Airlines (AAL) fell roughly 4% and Delta Air Lines (DAL) shed 3%.

Norwegian Cruise Line (NCLH) and Carnival (CCL) were both down more than 4%.

These Stocks Pass Buy Points

A number of stocks moved above entries despite the bearish action, though some retreated back below them.

National Storage Affiliates Trust closed in on the buy zone after passing a flat-base buy point of 65.08.

National Storage Affi Tr (NSA)

This is a second-stage base; breakouts from such early-stage patterns are more likely to succeed. Earnings performance is lagging at the moment, but overall performance is good.

Novo Nordisk sits a hair under its flat-base ideal entry point of 116.05. The diabetes play has a strong IBD Composite Rating of 88 out of 99. Big money has been getting behind the stock of late.

S&P Global closed above its buy point of 476.27. The stock has been seeing its relative strength line pick up lately. The fact that volume was low is a flaw, however.