We’re more than 6 weeks into 2022, and the market uncertainty that characterized January has, if anything, deepened. The sharp drops have turned instead to higher volatility, giving a chart of February’s trading a sawtooth look.

The volatility comes as a series of headwinds continue to impact trading sentiment. Stealing the headlines is the Russia-Ukraine situation. Foreign policy pundits are openly speculating on the prospect of war, in the event that Russia invades its neighbor and the US objects. For now, that situation is fluid and unpredictable.

On the domestic front, inflation is high and rising, while the jobs market shows the contradictory indicators of low unemployment and record-high job openings. The Federal Reserve is gearing up to start increasing interest rates in March, but that raises its own questions: Will the rate hikes curb inflation? Will they push into recession?

It’s all enough to give an investor a headache – and an incentive to move strongly into dividend stocks. These are the classic defensive plays, giving investors a dual path toward returns, from both the share appreciation and the dividend payments.

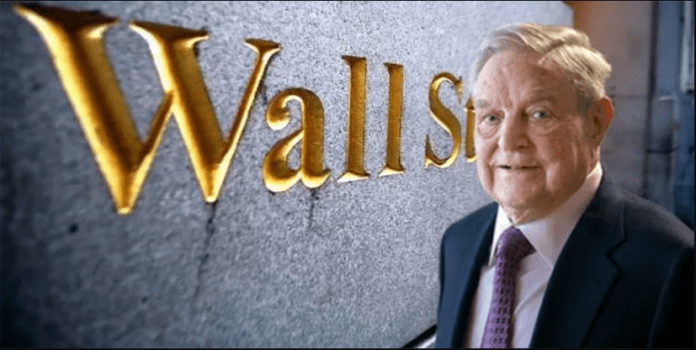

But which ones to buy? Enter George Soros.

His name has become something a lightning rod for controversy in recent years – but the man behind the name is one of the investing world’s true legends. He started his hedge fund, the Quantum Fund, back in 1973, and for the next three decades his average annualized returns exceeded 30%. This made him one of the most successful hedge managers around – and one of the richest men in the world.

With this in mind, we’ve opened up the TipRanks database to get the scoop on two of Soros’s recent new positions. These are Buy-rated stocks – and perhaps more interestingly, both are strong dividend payers. We can turn to the Wall Street analysts to find out what else might have brought these stocks to Soros’ attention.

Kimbell Royalty Partners (KRP)

The first of Soros’ new positions is Kimbell Royalty Partners, a company that works in both energy and real estate. Kimbell is a major landowner in proven hydrocarbon basins across the US, and the company makes its money on royalties from mineral (read – oil and gas) extraction from its properties. Those properties are extensive – Kimbell holds title to more than 13 million acres in some of the highest-yield production basins in the lower 48 states, including the Appalachian gas fields, the Bakken shale oil region, and the Permian Basin of Texas. One key statistic tells just how well-focused Kimbell’s holdings are: approximately 96% of all the onshore rigs in the continental US are in counties where Kimbell has land holdings.